- Home

- TDS Policy

TDS Policy for Online Rummy

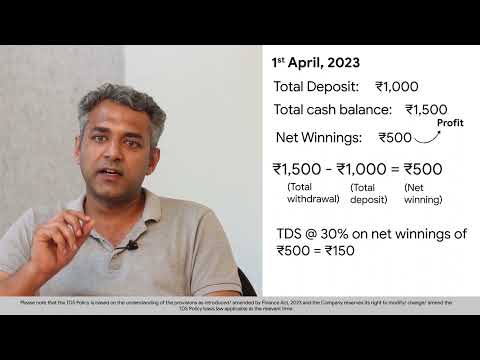

In line with the provisions contained in Finance Act, 2023, following TDS policy is applicable for all rummy players on RummyTime from 1 Apr, 2023.

- TDS is applicable at the time of withdrawal and also at the year end

- 30% TDS is applicable on net winnings at the time of withdrawal and also at the year end

Net winnings = Total withdrawals - Total deposits*(in a financial year i.e. 1 Apr to 31 Mar)

* Total deposits = deposits in the financial year + opening balance of the financial year

Any net winnings which have suffered TDS at the time of any earlier withdrawal would also be reduced while computing net winnings at the time of withdrawal.

Please note: The TDS Policy is based on the understanding of the provisions as introduced/ amended by Finance Act, 2023 and the Company reserves its right to modify/ change/ amend the TDS Policy basis law applicable at the relevant time.

Find below a few scenarios to understand application of the aforementioned TDS Policy.

Scenario 1:

- You have a balance of ₹10,000 in your account on 25 Mar, 2023 and you decide to withdraw on 5 Apr, 2023.

- On 1 Apr, 2023, ₹10,000 will be considered as your year opening balance which will be considered as a deposit in TDS calculation.

- No TDS will be applicable as your net winnings are ₹0.

Total withdrawals (A)

₹10,000

Total deposits (B)(same as opening balance)

₹10,000

Net winnings (A- B)

₹0

TDS applied

₹0

Scenario 2:

If your net winnings are less than or equal to ₹0, then TDS is not applicable.

Let us consider, you have a year opening balance of ₹3,000 as on 1 Apr, 2023 and have deposited ₹7,000 on 2 Apr, 2023.

Total deposits (B)

Opening balance (As of 1 Apr, 2023)

₹3,000

Deposit(Deposited on 2 Apr, 2023)

₹7,000

Total deposits (B)

₹10,000

Now, if you are withdrawing ₹5,000 on 3 Apr, 2023, here's how the TDS calculation will work.

Total withdrawals (A)

₹5,000

Total deposits (B)

₹10,000

Net winnings (A- B)

-₹5,000

TDS applied (As net winnings is negative)

₹0

In this case, no TDS was applied as the net winnings are negative

Scenario 3:

If your net winnings (including the withdrawal amount) are more than 0, then 30% TDS will apply to the net winnings at the time of withdrawal.

- Assume that in a financial year, you’ve deposited a total of ₹7,000 and have also had an opening balance of ₹3,000 at the start of this financial year. So now, your total deposit stands at ₹10,000 (₹3,000 + ₹7,000).

Total deposits (B)

Opening balance

₹3,000

Deposit

₹7,000

Total deposits (B)

₹10,000

- In the same financial year, you have completed a withdrawal of ₹5,000. And on 30 Apr, 2023, you wanted to withdraw an additional ₹7,000. So, with this withdrawal, your total withdrawal stands at ₹12,000 (₹5,000 + ₹7,000).

Total withdrawals (A)

Withdrawal on 23 Apr, 2023

₹5,000

Withdrawal on 30 Apr, 2023

₹7,000

Total withdrawals (A)

₹12,000

- In this case, on your withdrawal request of ₹7,000, TDS will be applied to the net winnings (A-B) of ₹2,000 (₹12,000 - ₹10,000) at a rate of 30%. However, no TDS will be applied to the remaining balance of ₹5,000. After deducting ₹600 TDS, ₹6,400 will be credited to your account.

Withdrawal amount

₹7,000

Amount eligible without tax

₹5,000

Taxable amount (Net winnings : A-B )

₹2,000

TDS on taxable amount @30%

-₹600

Amount to be credited to your

bank account

₹6,400

In this case, no TDS was applied as the net winnings are negative

Scenario 4:

If TDS has been applied to your previous withdrawals, then no TDS is applicable on withdrawals till your net winnings exceed the amount for which you have already paid TDS.

- Let us consider that as of 30 Apr, 2023, the following TDS calculations were applied:

Total withdrawals in the financial year = ₹20,000 Total deposits in the financial year = ₹14,000 So, your net winnings are = ₹6,000. On this ₹6000, your TDS @30% was applied = ₹1,800

- Now, as of 15 May, 2023, let us assume your deposits increase to ₹20,000 (₹14,000 as of 30 Apr, 2023 + ₹6,000 additional deposit between 30 Apr to 15 May).

Total withdrawals = ₹20,000.

Total deposits = ₹20,000 (₹14,000 as of 30 Apr + ₹6,000 additional deposit between 30 Apr to 15 May)

Net winnings previously taxed = ₹6,000 (₹1,800 TDS deducted on net winnings of ₹6,000 @ 30%)

Here, there could be two possibilities.

No TDS is applicable till your net winnings cross ₹6,000 as your winnings have already been taxed.

Possibility 1:

If you withdraw up to ₹6,000, no TDS is applicable (as TDS is already paid)

Withdrawal amount

₹6,000

Amount eligible without tax

₹6,000

Taxable amount (Net winnings : A-B )

₹0

TDS on taxable amount @30%

-₹0

Amount to be credited to your

bank account

₹6,000

Possibility 2:

If you withdraw ₹10,000, then TDS is applicable only on ₹4,000 net winnings @30% because you have already paid tax on ₹6,000. So, on withdrawal request of ₹10,000, TDS of ₹1,200 will be deducted and remaining amount of ₹8,800 will be credited to your bank account.

Withdrawal amount

₹10,000

Amount eligible without tax

₹6,000

Taxable amount (Net winnings : A-B )

₹4,000

TDS on taxable amount @30%

-₹1,200

Amount to be credited to your

bank account

₹8,800

Scenario 5:

Let us assume you have paid TDS on the initial winnings during the financial year, but your net winnings have reduced subsequently.

In this case on 30 Apr, 2023, following will be the TDS calculation in your account:

Total withdrawals (A)

₹20,000

Total deposits (B)

₹14,000

Net winnings (A- B)

₹6,000

TDS applied till date

₹1,800

- After this, on 15 May, 2023 your deposit reaches ₹20,000 (₹14,000 balance till 30 Apr + ₹6,000 additional amount deposited from 30 Apr to 15 May)

Total withdrawals in the financial year = ₹20,000 Net winnings in the financial year = ₹20,000- ₹20,000 = ₹0

TDS calculation as on 15 May, 2023

Total withdrawals (A)

₹20,000

Total deposits (B)

₹20,000

Net winnings (A- B)

₹0

In such a case, subject to applicable law, the excess TDS applied can be claimed as a refund during your annual income tax filing.

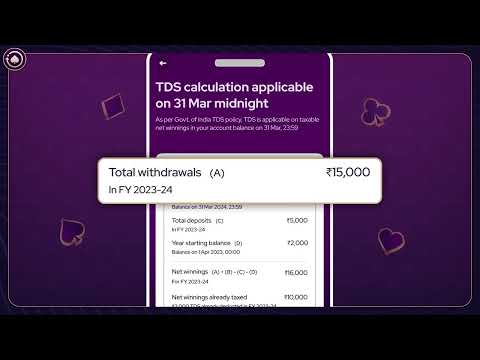

We are often asked what happens to the balance lying in an account at end of the financial year.

Scenario 6:

At the end of the financial year, if you have any amount remaining in your wallet (including table balances), TDS will be applied to such wallet balances if such balances contribute to any net winnings or profits for the financial year. The remaining amount will be carried forward to the next year as an opening balance. A withdrawal from the opening balance will not be subjected to TDS in the next year.

For example, let us assume:

Total deposits in the financial year = ₹40,000

Total withdrawals in the financial year = ₹40,000

TDS applied to date (on the winning amount of ₹5,000 as you had net winnings of ₹5,000 previously) = ₹1,500

Account balance at the end of 31 Mar, 2024 = ₹30,000

In this situation, following calculation will be done in your account:

Total withdrawals (A) Withdrawals of ₹40,000 + ₹30,000 a/c balance

₹70,000

Total deposits (B)

₹40,000

Net winnings (A-B)

₹30,000

Net winnings previously taxed

₹5,000

Taxable net winnings (₹30,000- ₹5,000)

₹25,000

TDS on taxable amount @30% 30% on ₹25,000

₹7,500

- Thus, TDS of ₹7,500 is applied to your account balance at the end of 31 Mar, 2024 and the remaining balance of ₹22,500 (₹30,000- ₹7,500) will be carried forward to the next financial year as a opening balance. TDS will not be applied in the next financial year on withdrawals of ₹22,500.

Please Note:

- Information provided on this page is for educational and informational purposes only and does not constitute tax advisory or recommendation. Players are requested to contact their financial and tax advisors for specific queries about their tax liability and tax related matters.