Offers based on TDS deductions

How to avail the offer?

Share offers with friends!

Calling all online rummy players to enjoy exclusive offers

FAQs

Listed below are the frequently asked questions by beginners for online rummy

How can I claim my TDS Refund?

To file your TDS online

- 1. You have to first register yourself on the IT department's website: https://www.incometax.gov.in/iec/foportal/.

- 2. Pre-validate the bank details by entering the bank account number and IFSC and nominate the bank account for refund.

- 3. After registration, you can file your income tax return by downloading the relevant ITR form.

- 4. Fill in the relavant details, upload the Form and click on submit.

Otherwise,

We have associated with ClearTax to help you file the income tax returns and claim your TDS refunds. You can go to theon our app to access the Clear Tax Portal and proceed with filing your returns

When can I make the claim for my TDS redund [file my Income tax returns]?

What are the documents I would need to keep handly in order to claim my TDS Refund [file my ITR] for my gamplay on RummyTime? Where can I find them?

How should I claim my TDS refund when I am playing games on RummyTime as well as other Real Money Gaming platforms?

I need help in claiming my TDS Refund [filing my income tax returns].

We would recommend that you talk to the Clear Tax customer support at 080674 58777, they would have the right expertise to help you with your queries

or

We would recommend you to visit

I have started filing my Income Tax Returns on ClearTax & need some assistance

We would recommend that you talk to the Clear Tax customer support at 080674 58777, they would have the right expertise to help you with your queries

or

We would recommend you to visit

I have made some error while filing the Income Tax return [claiming my TDS Refund]. How can I correct the same?

How can I track my TDS refund status

or

When will I recive the TDS refund after filing my income tax return?

Tax refunds are initiated by the tax department once you have e-verified your return

1. Typically, it takes 4-5 weeks for the refund to be deposited in your bank account

2. If the refund is not received within this timeframe, you should consider these steps:

2.1. Check intimation for any discrepancies or errors in your ITR (Log in to e-filing portal > e-File > Income Tax Returns > View filed returns)

2.2. Check your email for notifications from the Income Tax (IT) department regarding the status of the refund.

To know more we request you to contact Clear Tax Customer Support at 080674 58777

Is this offer open for all Rummy players or only for RummyTime players?

Can avail this offer to file ITR if i am playing on Multiple Rummy Brands?

How this offer will be Redeemed / availed to me?

or

Do I need to pay or are these services free?

How do i get Form 26AS?

Step 1 - Visit official Income tax efilling website - https://www.incometax.gov.in/iec/foportal/

Step 2 - Login either PAN or Aadhar number and click on 'Continue.'

Step 3 - Select "Income Tax Returns" from e-file.

Step 4 - click on 'View Form 26AS' and Select 'Confirm' next.

Step 5 - click on 'View Tax Credit (Form 26AS)'

Step 6 - Select the 'Assessment Year' and format you need to view Form 26AS. Step 7 - enter the 'Verification Code' and click on the 'View/ Download' button.

How do i get Form 16?

How do I get in touch with the assisted CA from cleartax

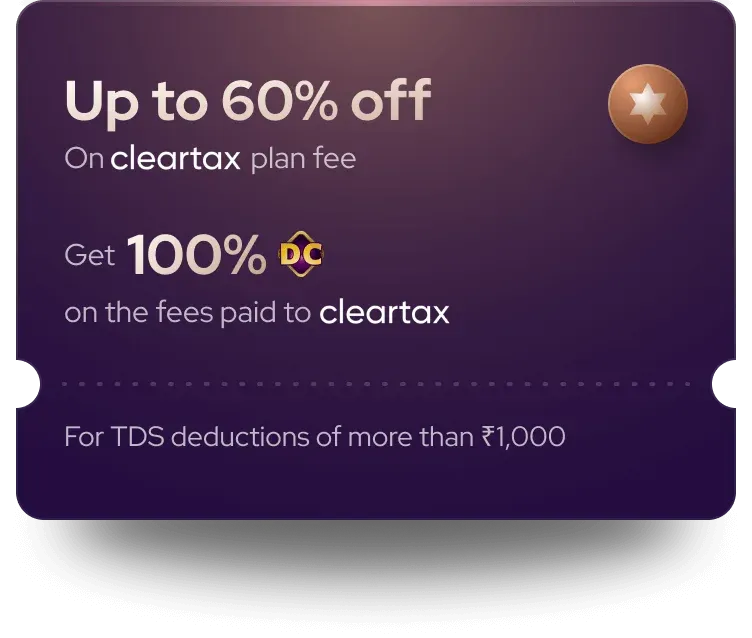

File for TDS refund at a discount!

Good news for all RummyTime players! We have partnered with ClearTax to enable you to file your ITR (Income Tax Return) for the financial year 2023-2024 through Clear Tax at a discount discount.

Benefits you get with this partnership

1.

Discounted filing with CA assistance : If you need any assistance from a Chartered Accountant (CA), you can get one on ClearTax. Users registered with RummyTime get an exclusive discount if they create a ClearTax account through the RummyTime app. TnCs Apply.

What is TDS?

Tax Deducted at Source (TDS) is the amount that is deducted from a certain payment. It helps the government prevent tax evasion by collecting it at the time of payment. In case of real-money games, it is the amount that is deducted on your net winnings at the time of withdrawals.

Provisions for taxation and TDS on winnings from online rummythe said date.

Currently, 30% TDS is charged on your net winnings in real-money gaming including online rummy. This tax is only deducted when you are withdrawing your winnings from a platform. Also, 28% GST is applicable on all deposits. All these taxes go straight to the government.

What is section 115BBJ?

Winnings from any online game shall be charged to tax under this section of the Income Tax Act, 1961.

30% tax is charged at the time of withdrawals on your net winnings.

The section was applicable from 1st April, 2023, i.e., any income from online games from the said date shall be taxable under this section.

What is section 194BA?

Any person responsible for paying to any person any income by way of winnings from any online game during the financial year shall deduct income-tax on the net winnings in his user account under the said section of Income Tax Act, 1961.

“Any Person” here means the one making payments of winnings or online gaming intermediary.

“Net Winnings” is A - (B + C), where A is the withdrawal amount, B is the sum of all non-tax deposits made by the user until the time of withdrawal and C is the opening balance at the beginning of a financial year.

“User Account” means a user who has registered with an online gaming intermediary, delivering one or more online games.

The section was applicable from 1st July, 2023, i.e., tax shall be deducted from any income from online games from the said date.

*Discount Credits equivalent to the fees you pay on ClearTax will be added to your RummyTime a/c on completion of filing.